The IRS Cryptocurrency Crackdown

Trading in Bitcoin? Getting paid by a client via Coinbase? It’s clear the IRS is no longer ignoring cryptocurrency activity. In fact, it’s planning to spotlight virtual currency front-and-center on the first page of your 2020 personal income tax return. “It first became part of the wider 1040 individual tax return form for 2019, but […]

What’s in a Name? The Business Value of YOU

In a significant move last year, the NCAA decided to allow individual athletes to profit from their own name, image, and likeness. While you may not be a superstar on the court, you might be able to “bank” on your name, too. If you’re a business owner, it’s a worthwhile consideration because it can drive […]

Surprise Nonpayment Notice? Mail Delays and Your Taxes

The IRS had up to 12 million pieces of unopened mail at one point this summer. That mail may have included your tax payment. And while that backlog is painstakingly sorted, you may have been shocked to receive a nonpayment notice along with threats of penalties and late fees. “If a taxpayer mailed a check […]

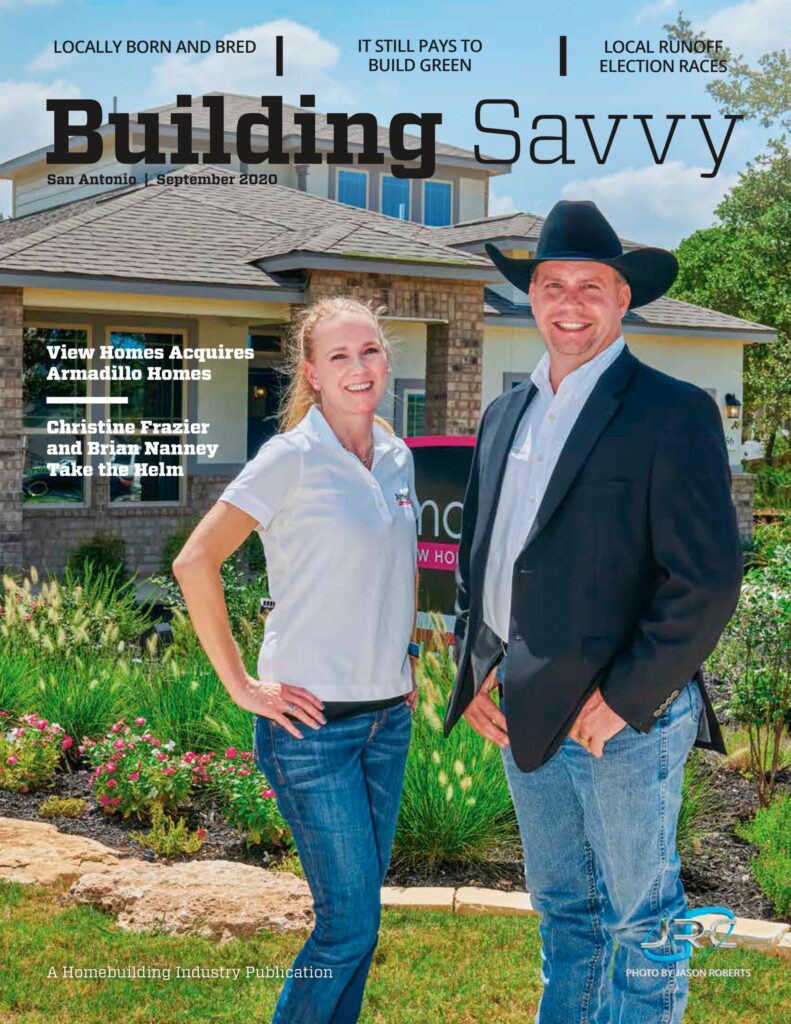

It Still Pays to Build Green

The COVID-19 pandemic has held up many construction projects, including those that develop renewable energy. For this reason, the U.S. Treasury Department and IRS have modified the beginning of construction requirement for both the production tax credit for renewable energy facilities and the investment tax credit for energy property. They’ve extended an important safe-harbor allowance […]

Eldercare and Your Taxes

As nursing homes and eldercare facilities have been in lockdown this year, you may have suddenly taken on primary caregiver responsibilities for a loved one. It’s a tough job and one that only becomes more daunting as the bills pile up. But there are some critical tax deductions you can take as a caregiver that […]