Captive Insurance Risks And Rewards

The Tax Cuts and Jobs Act introduced a new tax-lowering investment tool called Qualified Opportunity Zones (QOZ’s). Those willing to invest longterm in QOZ’s receive special tax advantages. But it’s new territory for both investors and developers, and with that new territory comes a learning curve. Click To View

What’s the Deal With Opportunity Zones?

The Tax Cuts and Jobs Act introduced a new tax-lowering investment tool called Qualified Opportunity Zones (QOZ’s). Those willing to invest longterm in QOZ’s receive special tax advantages. But it’s new territory for both investors and developers, and with that new territory comes a learning curve. Click To View

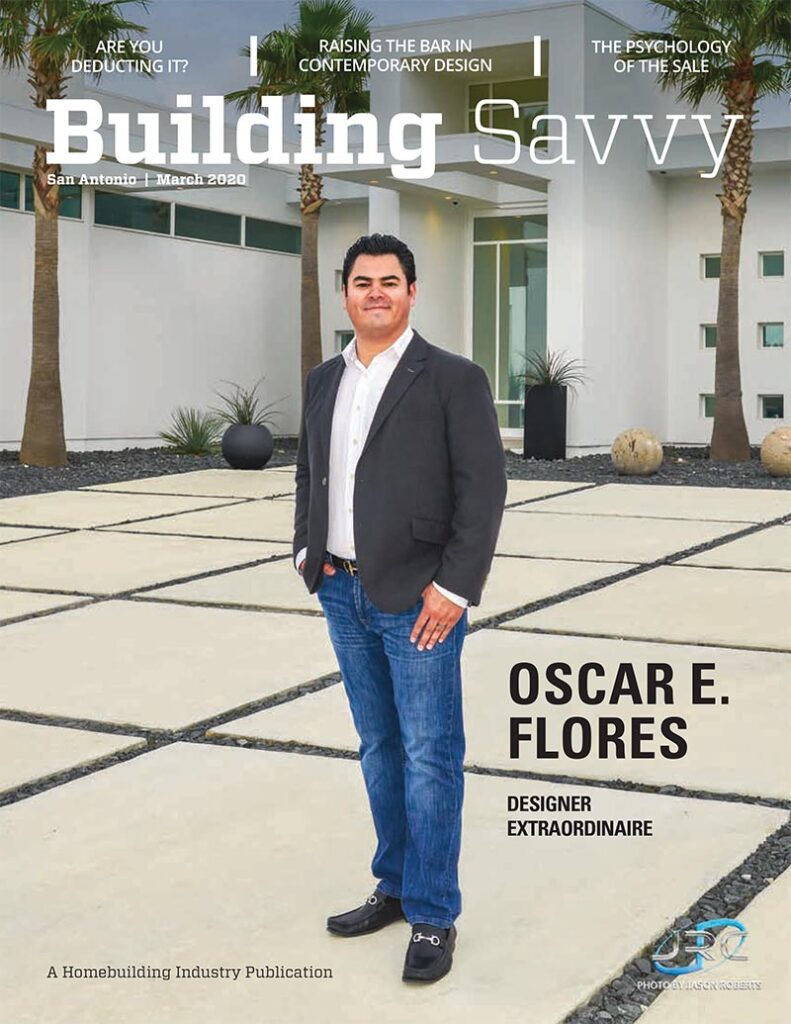

Savvy Finance: Are You Deducting It?

Running your own business? Small business deductions can really add up for entrepreneurs. And while many business owners are on top of deductions like meals and entertainment, mileage, and payroll taxes, dozens of other deductions can be overlooked. Don’t forget to log the following expenses for consideration when tax time rolls around… Click To View

How Sales Taxes Affect Your Bids: Loans Between Loved Ones

Loaning money to family and friends is tricky business for many reasons. Taxes are among them. Funds received as proceeds of a loan aren’t taxable if the borrower is expected to pay it back. However, the moment some or all of the debt is forgiven (doesn’t need to be paid back), the IRS will want […]

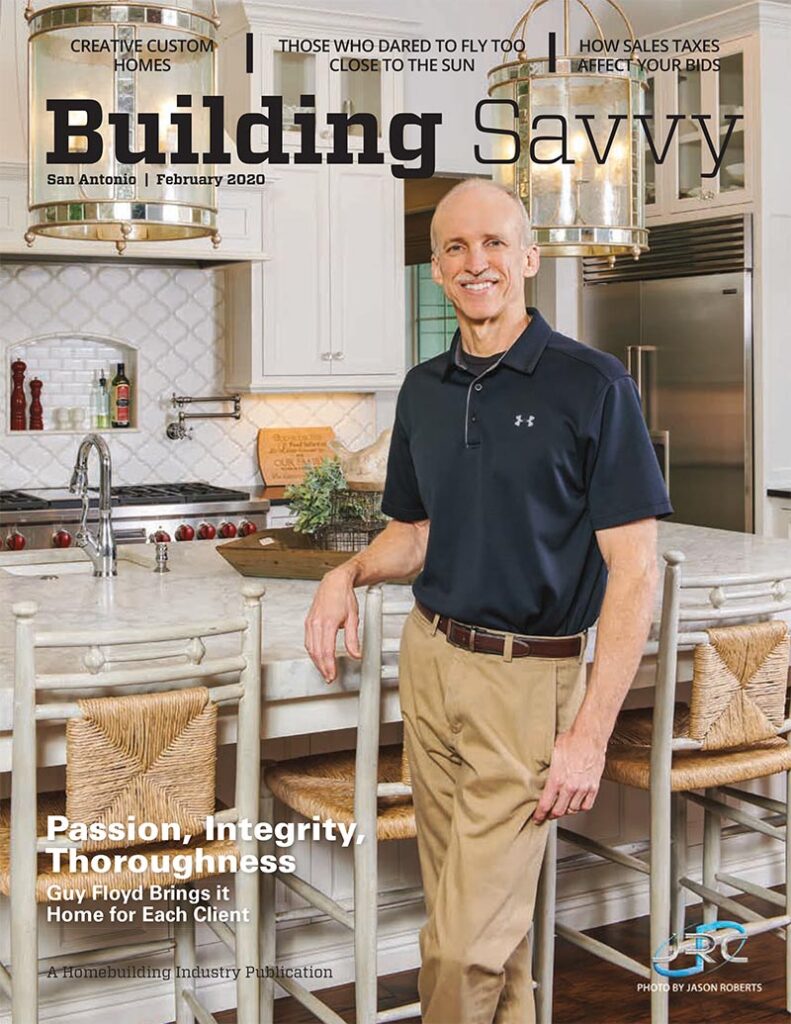

How Sales Tax Affects Your Bids

Correctly estimating your bids is essential to creating trust with your customers and, yet, many factors can throw a project’s original price tag out the window. These often include elements mostly out of your control, such as working with inaccurate specifications, getting hit with rising material and labor costs, and more. Click To View

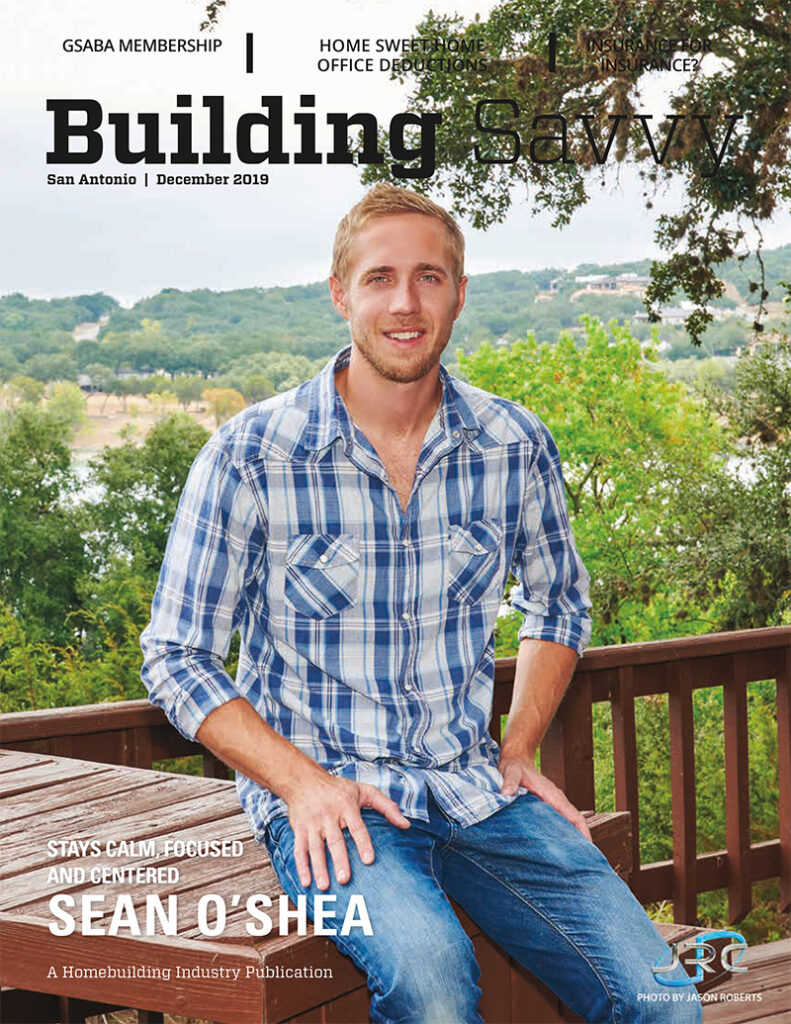

Home Sweet Home Office Deductions

Work from home regularly? Many people do these days. Thanks to technology, an increasing number of executives and business owners find that working from home can be just as productive as heading into the office. You can even get a tax deduction for your home office if you meet IRS criteria. Click To View

Giving Back And Your Taxes

‘Tis the season for giving, but consider how recent tax changes affect your charitable contributions before you open your wallet. Whether your donations result in lower taxes depends on highly individualized factors. Seemingly huge tax breaks may not pan out for even generous givers who haven’t rethought their tax strategies. Those strategies now include tools […]

How Employee Theft Could Destroy Your Business

If you’re a business owner, you may feel that you’ve built up a sixth sense when it comes to choosing the right business partners and customers. Fraud is all around us these days, after all, and it’s important to know who to trust. But it’s not just strangers who find us vulnerable. Your employees could […]

Five IRS Audit Mistakes To Avoid

The IRS audits about 1 million taxpayers each year. While the agency is understaffed, that doesn’t mean you’ll slip through the cracks. IRS software automates the selection process now by flagging returns that show abnormalities: Perhaps the return deviates from what’s normally filed, or it’s been linked to a family member, investor, or business partner […]

Small Contractor Tax Relief: Do You Qualify?

If you’re a small business contractor with annual gross receipts averaging $25 million or less in the past three-year period, the recent tax changes may have given you a valuable leg up. The small contractor exemption threshold has increased for the first time since 1986, allowing more building contractors to pick the accounting option that […]