Taxes, Gig Workers, And Your Seasonal Help

Did you hear the big employment law news out of California? The state’s businesses are facing strict new limits on using independent contractors. It’s a valuable reminder that not all workers are equal in the eyes of the government, especially those considered independent contractors versus employees. Under a new ruling, slated to take effect January […]

Behold This CEO’s “Sick” Tax Crimes

A CEO of two Denver-area technology companies was found guilty on a host of charges, including impeding the administration of tax laws, conspiracy to defraud the U.S. government, and conspiracy to steal employee benefit plan funds. He’s been sentenced to over six years in federal prison. More tragically, however, his deception led to his employees […]

You Can’t Beat The IRS With A Dead Horse

Some people seem to think the IRS will overlook just about anything. But a dead horse? That’s hard to miss. When a California-based horse enthusiast and IT business owner’s last horse died in 2008, being horseless didn’t stop her from continuing to claim business deductions for her horse-related endeavors. The IRS noticed and took a […]

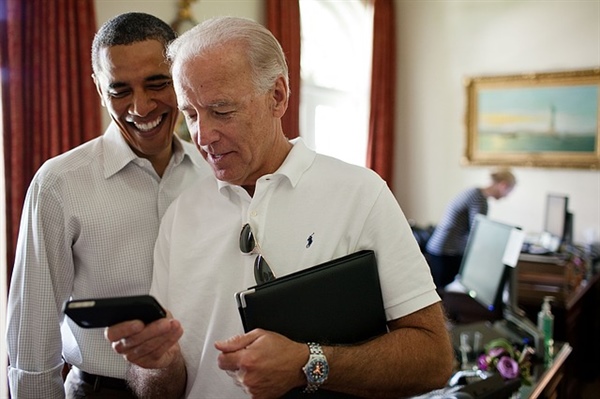

Joe Biden’s Bold Tax Loophole

In case you missed it, presidential candidate and former Vice President Joe Biden released his tax returns this summer. He makes a lot, but that’s not what has business owners and accountants talking. Biden and his wife Jill made $15.6 million in 2017 and 2018, which is impressive considering that, while still serving in the […]

Bonus Depreciation Relief For Some 2017-18 Purchases

The IRS will now permit taxpayers to change their bonus depreciation treatment for property acquired after Sept. 27, 2017, and placed in service during a tax year that includes Sept. 28, 2017. Business owners rejoiced when Section 168 of the tax code was changed in 2018, doubling the bonus depreciation allowed, expanding the definition for […]

Taxability Of Employee Snacks Versus Meals

Here’s something to chew on: The IRS continues to clarify its position on deducting the cost of free food provided to employees. This time, office snacks get a delicious boost while other meals lose their deductibility entirely. The Tax Cuts and Jobs Act (TCJA) reduced the tax breaks employers can receive when feeding employees, but […]

Employee Theft Could End Your Business

Fraud is all around us these days, but it’s not just strangers who find us vulnerable. Your own employees could be stealing from you. The problem can be especially devastating for small business owners, who surprisingly tend to lose the most. The Association of Certified Fraud Examiners (ACFE) conducts the foremost study in the area […]

Tom Petty’s Estate Is Free Fallin’

There’s no doubt the late, great rock star Tom Petty thought he had his legacy all wrapped up in a neat package before he passed away. Like too many before him, he was wrong. Unlike Aretha Franklin, Prince, and so many other rock-and-roll legends who died with ambiguous wills or no estate planning at all, […]

Work During Vacation Could Pay Off

Mixing business with pleasure while traveling this summer? Some of it might be tax deductible, but the rules are tricky. Your ability to deduct travel expenses depends on these six factors: Where you go. The IRS treats deductible travel expenses within the U.S. differently than travel expenses incurred internationally. When traveling abroad, for instance, individuals […]

Business Tax Deduction Faqs

What expenses can my business deduct on its taxes? It’s such a simple question, yet the answer is shockingly complex. No tax situation is one-size-fits-all, and the rules are constantly changing. To offer clarity, we found some of the most “Googled” business deduction questions and answer them here. Can my business deduct charitable contributions? Yes, […]