Oct 10, 2021

The American tax system is filled with tax breaks that can save you thousands of dollars, as long as you know where and how to look. But the system is decidedly not “user friendly,” which is why many taxpayers miss out. Finding a savvy tax preparer who...

read more

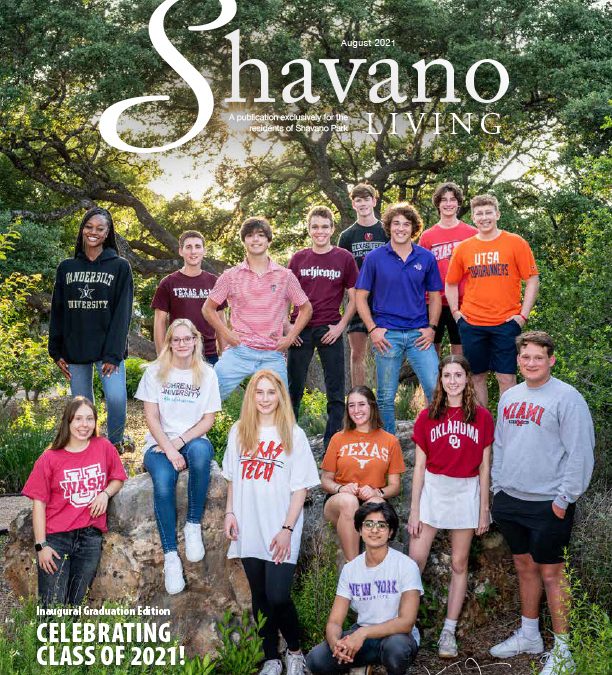

Aug 8, 2021

The construction industry has been through a rollercoaster of highs and lows the past couple of years. The pandemic has caused volatility in project timelines, staffing, regulations, and the supply chain in ways that may have forced you to reinvent how...

read more

Aug 1, 2021

There is only one certainty for business owners: You won’t be able to stay at the helm forever. You’ll exit, either by choice or by circumstance. Some business owners prepare years in advance for that day, but family business owners don’t often have such a clear...

read more

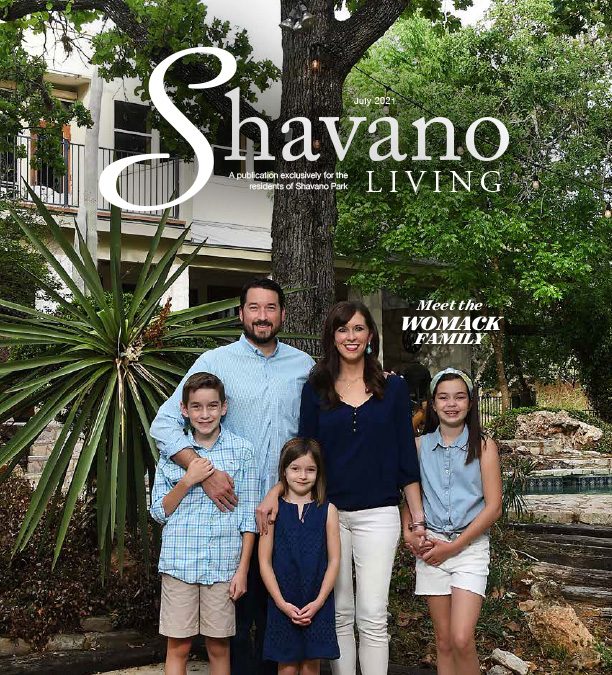

Jul 13, 2021

It’s always a party at our neighborhood spot, El Mirasol. Corinna’s birthday was a great excuse to indulge in some tasty...

read more

Jul 1, 2021

Many valuable coins, stamps, artwork, cars, and other collectibles are considered alternate investments by the IRS. With the pandemic reportedly sparking new interest in memorabilia and the trading of collectibles going digital–some using online tokens as...

read more