Sep 9, 2019

The IRS audits about 1 million taxpayers each year. While the agency is understaffed, that doesn’t mean you’ll slip through the cracks. IRS software automates the selection process now by flagging returns that show abnormalities: Perhaps the return deviates from...

read more

Aug 5, 2019

If you’re a small business contractor with annual gross receipts averaging $25 million or less in the past three-year period, the recent tax changes may have given you a valuable leg up. The small contractor exemption threshold has increased for the first time since...

read more

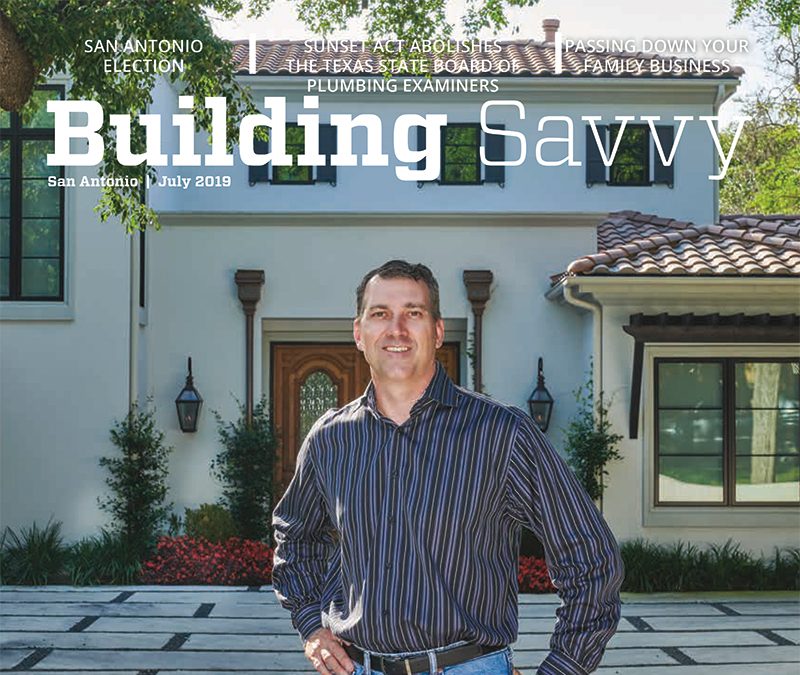

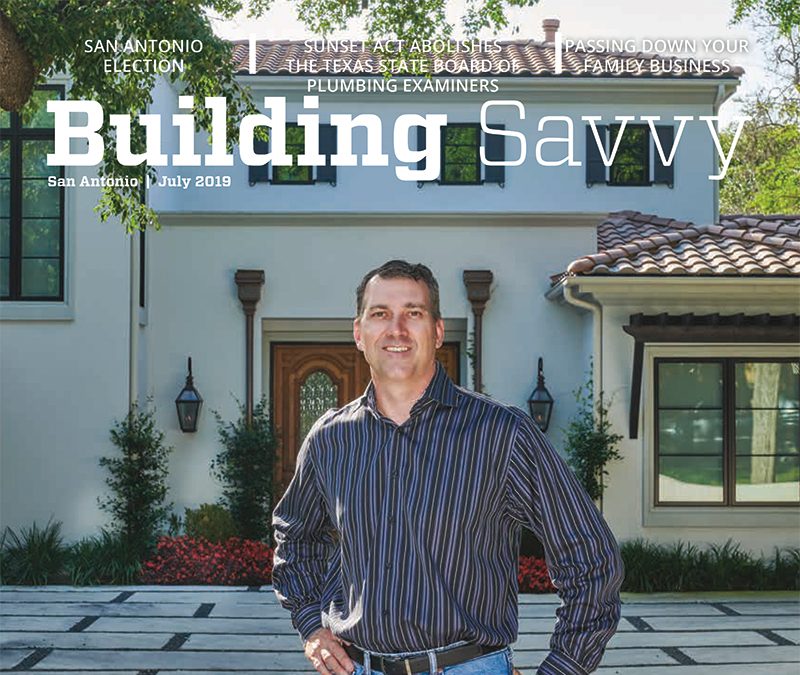

Jul 1, 2019

If it’s the latter, emotions can further complicate matters. Family business owners are often caught without a safety net when the sons or daughters they always envisioned running the business one day are either unwilling or unable to do so. Click To...

read more

Jun 3, 2019

If you’re planning on retiring soon, congratulations! Enjoy and celebrate, but also take some time to understand how retiring right now will influence your future tax returns. Click To...

read more

Mar 4, 2019

Maybe you’ve been challenged to build stronger, lighter, faster, or more environmentally friendly, energy efficient, or automation-enabled. Perhaps the architectural design of the home is unique and requires outside-the-box building techniques or materials. Or maybe...

read more

Feb 5, 2019

While the decision shouldn’t be taken lightly and could incur significant costs, reviewing your options should be something you do on a regular basis, similar to performing regular maintenance on a vehicle, so it continues to run smoothly. Even seemingly small changes...

read more