LinkedIn: Only a handful of known billionaires could be responsible, but there are no obvious suspects. Was it tax planning at its worst or its most brilliant?

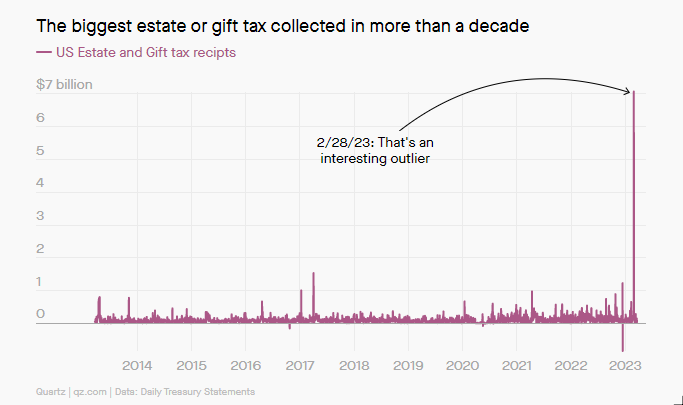

In one single day this past February, the U.S. Treasury recorded a deposit of $7 billion in the category of estate and gift taxes, the highest collection of that kind of tax since at least 2005.

Who is responsible? That’s for the Treasury to know (the rest of us may never find out). It’s reported that John Ricco, associate director of budget analysis at the University of Pennsylvania’s Penn Wharton Budget Model, was first to spot the line item on the Treasury’s usually mundane daily report.

“A Treasury spokesperson says this was not a reporting error, and a spokesperson for the Internal Revenue Service says it is unlikely this would be caused by processing a backlog of returns in one day,” writes Quartz’s Tim Fernholz. In other words, the source is almost certainly one single taxpayer. Only a handful of known billionaires could be responsible, but there are no obvious suspects.

The IRS lumps estate and gift taxes into one reporting category dealing with the transfer of wealth, but there are differences. Simply put, estate taxes apply to property you transfer to another person after death. Less than 2% of American taxpayers exceed the current threshold for paying federal estate taxes ($12.92 million in 2023), although certain state estate taxes outside of Texas have much lower thresholds.

Gift taxes, however, apply to any money you give to another person during your lifetime. The threshold is much lower ($17,000 in 2023); it’s likely you’ve already experienced meeting it or edging towards it at some point yourself (either as a giver or receiver).

Many acceptable tools and strategies can help taxpayers avoid these taxes. Setting up certain trusts for estate transfers and paying for medical or education expenses instead of making unspecified gifts are examples. The ultra-wealthy have even more tricks to skirt around being taxed for wealth transfers (we cover some of them here and here).

So, what happened in this case? It’s anyone’s guess. To get a better idea of how exceptional this daily tax report truly was, Fernholz provides a visual:

He goes on to report speculation from experts about possible sources:

- Gabriel Zucman, an economist at the University of Berkeley, hints at a very rich person who somehow eluded public detection, a large gift, or “a delayed payment by some billionaire who died several years [ago].”

- Zucman also notes that the tax can be triggered by divorces involving spouses without American citizenship, but payments within a year of the divorce are generally excluded.

- Ray Madoff, a tax law professor at Boston College, says that someone with a large estate might have chosen to make a taxable gift now to avoid future estate taxes on their entire net worth.

- Forbes notes the death of “richest people” list member Sheldon Adelson in Jan. 2021; the casino tycoon’s fortune was estimated at $35 billion, which is “about the right magnitude.”

Was it tax planning at its worst or its most brilliant? We may never know. Feel free to contact us with questions.