Jul 16, 2019

There’s no doubt the late, great rock star Tom Petty thought he had his legacy all wrapped up in a neat package before he passed away. Like too many before him, he was wrong. Unlike Aretha Franklin, Prince, and so many other rock-and-roll legends who died with...

read more

Jul 9, 2019

Mixing business with pleasure while traveling this summer? Some of it might be tax deductible, but the rules are tricky. Your ability to deduct travel expenses depends on these six factors: Where you go. The IRS treats deductible travel expenses within the U.S....

read more

Jul 1, 2019

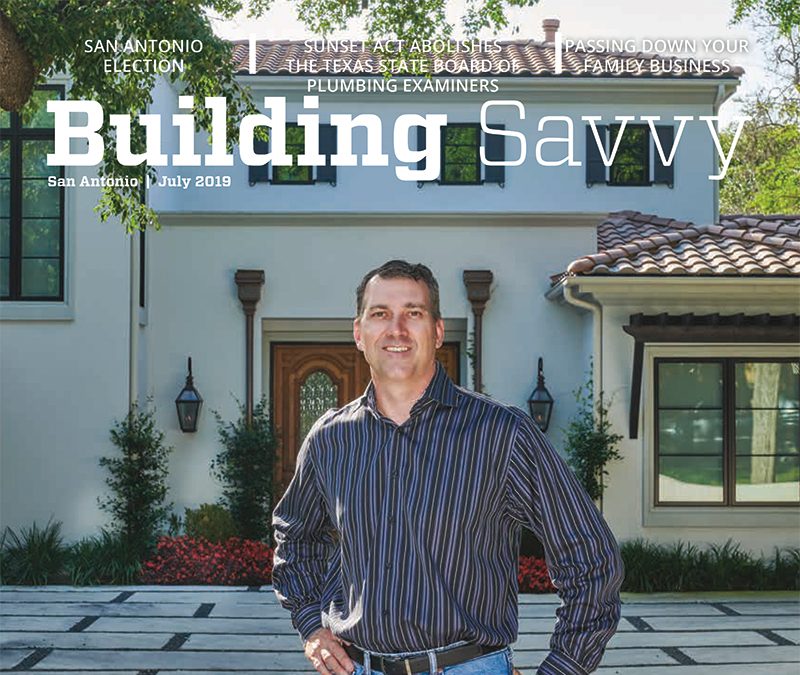

If it’s the latter, emotions can further complicate matters. Family business owners are often caught without a safety net when the sons or daughters they always envisioned running the business one day are either unwilling or unable to do so. Click To...

read more

Jul 1, 2019

As your net worth grows, your financial advisor may suggest diversifying your portfolio with alternative investments. These assets can include gold and real estate. Cryptocurrencies are another emerging investment area. The amount you invest and how you invest in...

read more

Jun 25, 2019

What expenses can my business deduct on its taxes? It’s such a simple question, yet the answer is shockingly complex. No tax situation is one-size-fits-all, and the rules are constantly changing. To offer clarity, we found some of the most “Googled” business deduction...

read more

Jun 18, 2019

Qualified moving expense tax treatment for employees has changed under the Tax Cuts and Jobs Act (TCJA). The transition started in 2018, but taxpayers are still being blindsided by what’s no longer covered. Through 2025, employers must include all moving expense...

read more