Oct 15, 2019

A CEO of two Denver-area technology companies was found guilty on a host of charges, including impeding the administration of tax laws, conspiracy to defraud the U.S. government, and conspiracy to steal employee benefit plan funds. He’s been sentenced to over six...

read more

Oct 8, 2019

Some people seem to think the IRS will overlook just about anything. But a dead horse? That’s hard to miss. When a California-based horse enthusiast and IT business owner’s last horse died in 2008, being horseless didn’t stop her from continuing to claim business...

read more

Sep 24, 2019

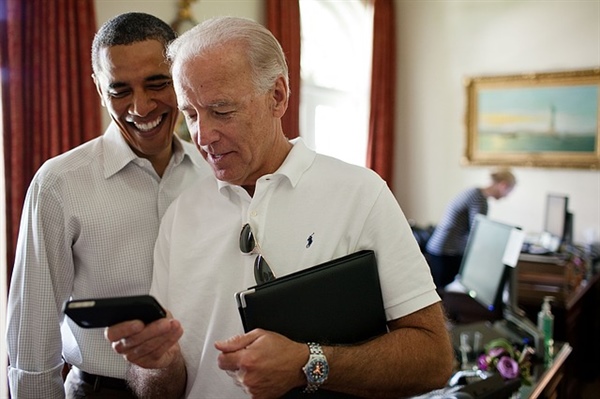

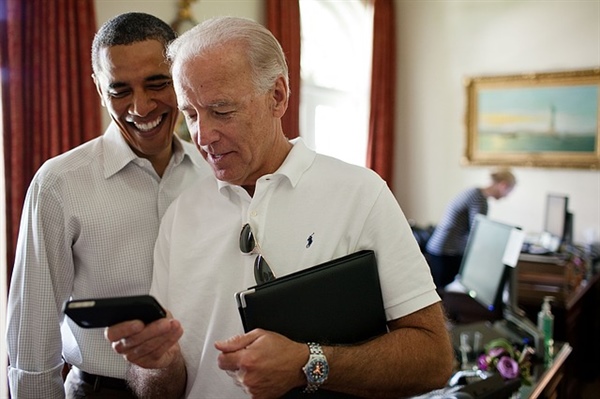

In case you missed it, presidential candidate and former Vice President Joe Biden released his tax returns this summer. He makes a lot, but that’s not what has business owners and accountants talking. Biden and his wife Jill made $15.6 million in 2017 and 2018,...

read more

Sep 17, 2019

The IRS will now permit taxpayers to change their bonus depreciation treatment for property acquired after Sept. 27, 2017, and placed in service during a tax year that includes Sept. 28, 2017. Business owners rejoiced when Section 168 of the tax code was...

read more

Aug 20, 2019

Here’s something to chew on: The IRS continues to clarify its position on deducting the cost of free food provided to employees. This time, office snacks get a delicious boost while other meals lose their deductibility entirely. The Tax Cuts and Jobs Act (TCJA)...

read more

Aug 8, 2019

Lawsuit settlements just became more profitable…for the IRS. Under the new tax code, most personal claims are now taxed at 100% with no deduction for legal fees. That’s right: In those cases, the plaintiff will be taxed on the fees paid to the attorney and so...

read more